All Categories

Featured

Table of Contents

A PUAR allows you to "overfund" your insurance plan right approximately line of it becoming a Modified Endowment Agreement (MEC). When you make use of a PUAR, you quickly boost your cash value (and your survivor benefit), thereby enhancing the power of your "financial institution". Further, the even more cash worth you have, the higher your passion and dividend repayments from your insurer will be.

With the surge of TikTok as an information-sharing platform, financial recommendations and methods have actually found a novel method of dispersing. One such method that has been making the rounds is the unlimited banking principle, or IBC for brief, gathering recommendations from celebrities like rapper Waka Flocka Fire. However, while the technique is currently preferred, its roots map back to the 1980s when economic expert Nelson Nash introduced it to the world.

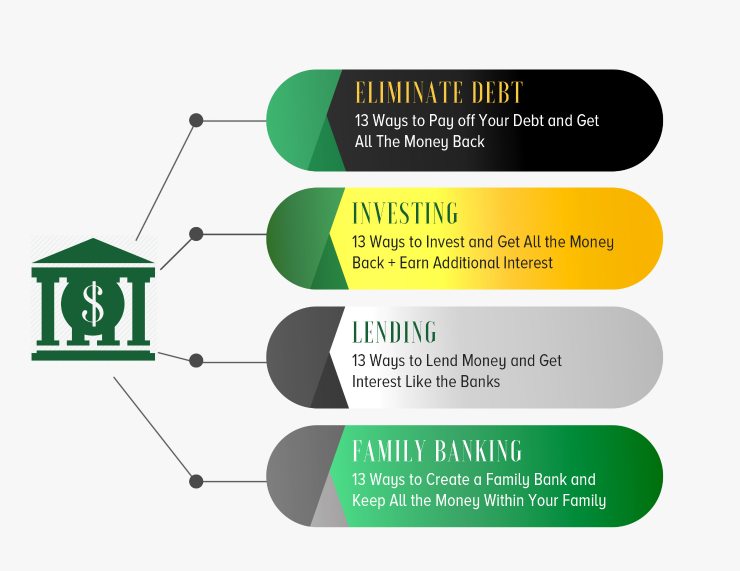

Private Banking Strategies

Within these plans, the money value grows based on a rate established by the insurer (Borrowing against cash value). When a substantial cash value gathers, policyholders can obtain a cash worth car loan. These lendings vary from conventional ones, with life insurance policy working as security, indicating one could lose their insurance coverage if borrowing excessively without adequate money worth to support the insurance costs

And while the appeal of these policies appears, there are natural restrictions and dangers, necessitating diligent money value monitoring. The approach's legitimacy isn't black and white. For high-net-worth people or organization owners, specifically those making use of techniques like company-owned life insurance (COLI), the advantages of tax obligation breaks and substance growth can be appealing.

The allure of boundless banking doesn't negate its challenges: Expense: The foundational requirement, a long-term life insurance policy policy, is pricier than its term equivalents. Eligibility: Not everybody gets approved for whole life insurance policy due to extensive underwriting processes that can leave out those with particular health or lifestyle problems. Intricacy and danger: The detailed nature of IBC, coupled with its risks, may hinder lots of, especially when easier and less high-risk options are readily available.

How do interest rates affect Wealth Management With Infinite Banking?

Designating around 10% of your regular monthly earnings to the plan is just not feasible for many people. Using life insurance policy as an investment and liquidity resource needs technique and monitoring of policy cash worth. Get in touch with a monetary expert to identify if unlimited financial straightens with your concerns. Part of what you read below is merely a reiteration of what has actually currently been claimed above.

Prior to you get on your own into a situation you're not prepared for, know the complying with first: Although the idea is generally sold as such, you're not really taking a car loan from yourself. If that held true, you wouldn't have to settle it. Rather, you're obtaining from the insurance policy business and have to settle it with rate of interest.

Some social networks messages suggest making use of cash money value from entire life insurance to pay for bank card debt. The concept is that when you pay off the car loan with passion, the quantity will be sent back to your financial investments. Sadly, that's not just how it functions. When you repay the car loan, a section of that passion mosts likely to the insurer.

For the initial several years, you'll be paying off the commission. This makes it very tough for your policy to accumulate worth during this time. Unless you can afford to pay a couple of to a number of hundred dollars for the next years or even more, IBC won't function for you.

Infinite Banking Concept

Not every person must rely entirely on themselves for monetary protection. If you call for life insurance coverage, right here are some important tips to think about: Take into consideration term life insurance policy. These policies offer coverage throughout years with significant economic obligations, like mortgages, student fundings, or when taking care of kids. Ensure to look around for the very best price.

Visualize never needing to worry regarding financial institution car loans or high rates of interest once again. What happens if you could borrow money on your terms and build wealth at the same time? That's the power of unlimited banking life insurance policy. By leveraging the cash value of whole life insurance IUL plans, you can grow your wealth and obtain cash without counting on traditional banks.

There's no set lending term, and you have the flexibility to pick the payment schedule, which can be as leisurely as settling the funding at the time of fatality. Bank on yourself. This adaptability reaches the maintenance of the financings, where you can choose interest-only payments, keeping the car loan equilibrium flat and workable

Holding cash in an IUL fixed account being attributed rate of interest can typically be better than holding the cash money on down payment at a bank.: You've always desired for opening your own pastry shop. You can borrow from your IUL plan to cover the initial expenses of renting out an area, purchasing equipment, and employing personnel.

What are the common mistakes people make with Infinite Banking Benefits?

Personal car loans can be acquired from traditional financial institutions and credit rating unions. Obtaining money on a credit scores card is normally extremely expensive with annual percentage rates of passion (APR) frequently reaching 20% to 30% or even more a year.

Table of Contents

Latest Posts

Be Your Own Bank

Infinite Banking Spreadsheet

Infinity Life Insurance

More

Latest Posts

Be Your Own Bank

Infinite Banking Spreadsheet

Infinity Life Insurance